The world has spent the last several weeks celebrating the small. We’ve all enjoyed watching the success of the American women’s gymnastics team, which won the team gold medal at the Olympics in Paris. Simone Biles, in particular, was spectacular, living up to her billing as one of the all-time greats by winning the gold medal in the all-around competition. She is the first woman to win the all-around twice since Larisa Latynina of the Soviet Union did it in 1956 and 1960. Simone Biles is a giant in her sport… and she is 4’8”!

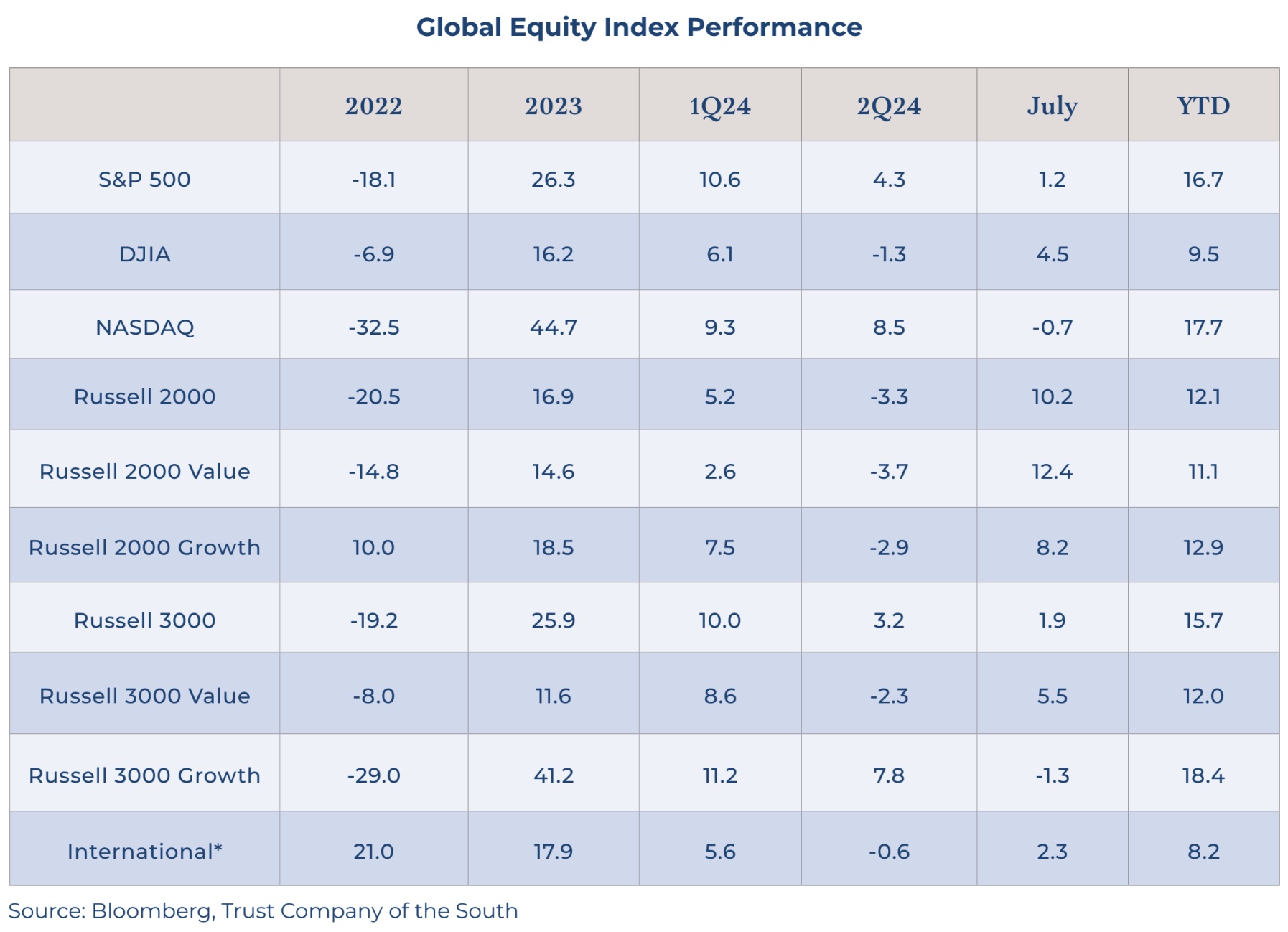

Meanwhile, in the financial markets, we’ve also seen powerful vaults and mighty rotation. Investors snapped up shares of small-cap stocks and value stocks at extraordinary levels, shunning the mighty Magnificent Seven. Growth-oriented equity indices, such as the NASDAQ and the Russell 3000 Growth fell slightly, while the Russell 2000, which tracks small caps, soared more than 10%. The Russell 2000 Growth index advanced more than 8%, and the Russell Value index leaped more than 12%.

Our friends at Dimensional Fund Advisors noted the following:

- Small value outperformed large growth by more than 2.5 percentage points three times over a five-trading-day span (July 11, 16 and 17). Return spreads that large are uncommon, occurring only 96 times out of 8,124 days going back to June 1993.

- July 11 was the fifth-largest spread ever at 6.13 percentage points, exceeding any day during the early 2000s small value turnaround. (The largest daily spread of 8.71 percentage points on November 9, 2020, the day Pfizer announced the efficacy rate from its COVID vaccine tests).

- The five-day cumulative return spread on July 17 was 14.83 percentage points, the largest ever for these indices. That spread was more than 2.5 times the 99th percentile five-day spread of 5.65 percent.

- While small value still trails large growth over the last three years, the annualized deficit dropped from 10.73 percentage points as of July 10 to 5.76 percentage points through July 17. Nearly half the gap closed in the span of just five trading days.

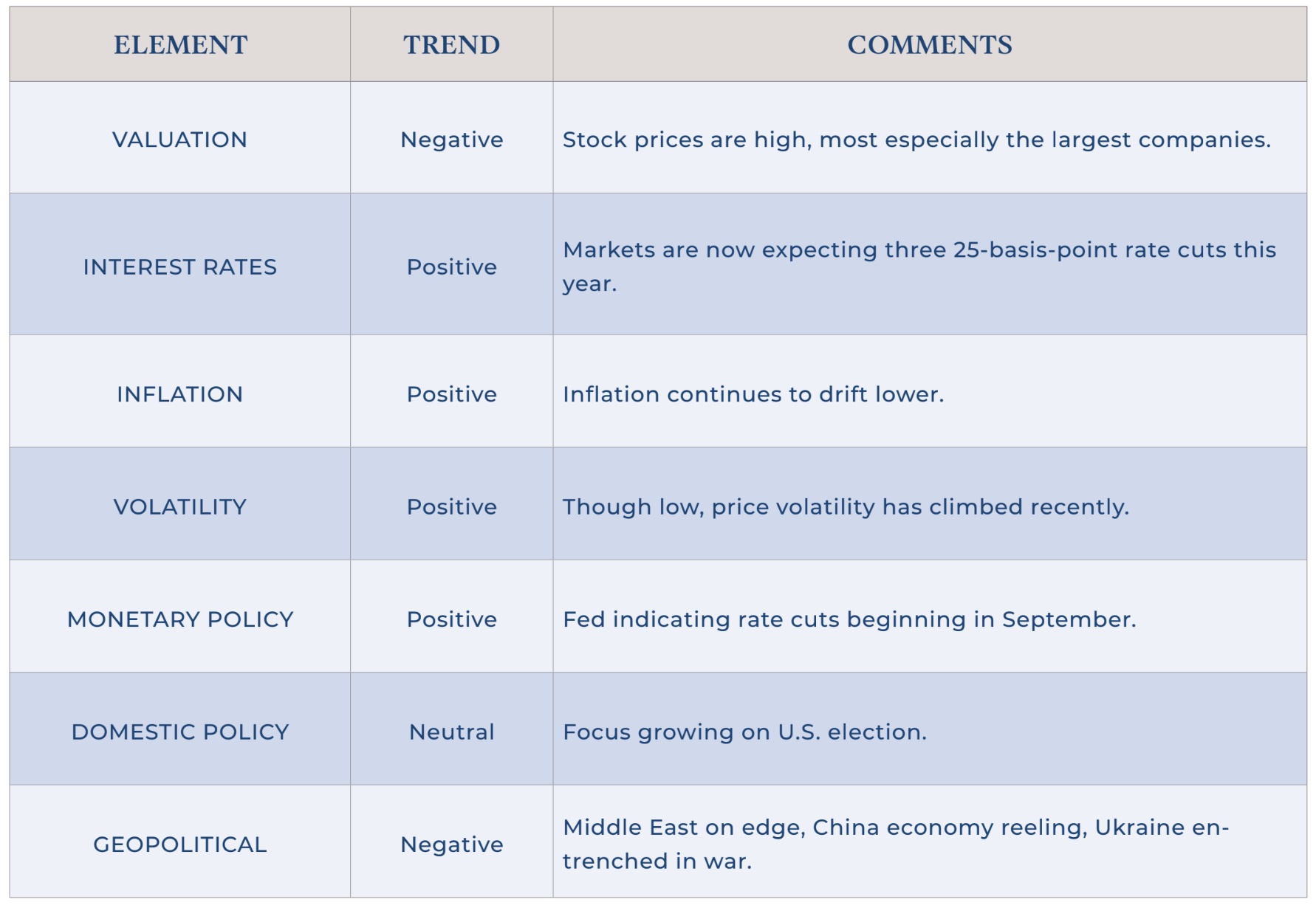

While one month does not necessarily a trend make, there’s little doubt that the momentum that had been carrying the Magnificent Seven higher, and taking the whole S&P 500 along with it, has dissipated.

So, what happened? Mixed earnings results from AI darlings NVIDIA, Microsoft and Google raised questions about the timing and returns on the massive investments these companies are making, and with the prices of those stocks at nosebleed levels, there was absolutely no room for anything other than promises of extraordinary earnings growth. Those are tough bets to make. When stocks have perfection priced in, and the future brings even the tiniest cloud, repricing can be swift and severe.

What’s interesting is that the performance of the Magnificent Seven during the month was not all that bad. Four of the seven were down mid-single digits (Microsoft, NVIDIA, Google and Meta) but as a group, they were down just 2%. It was the Simone Biles-esque rotation toward and vaulting into stocks beyond mega-cap tech that really defined the month.

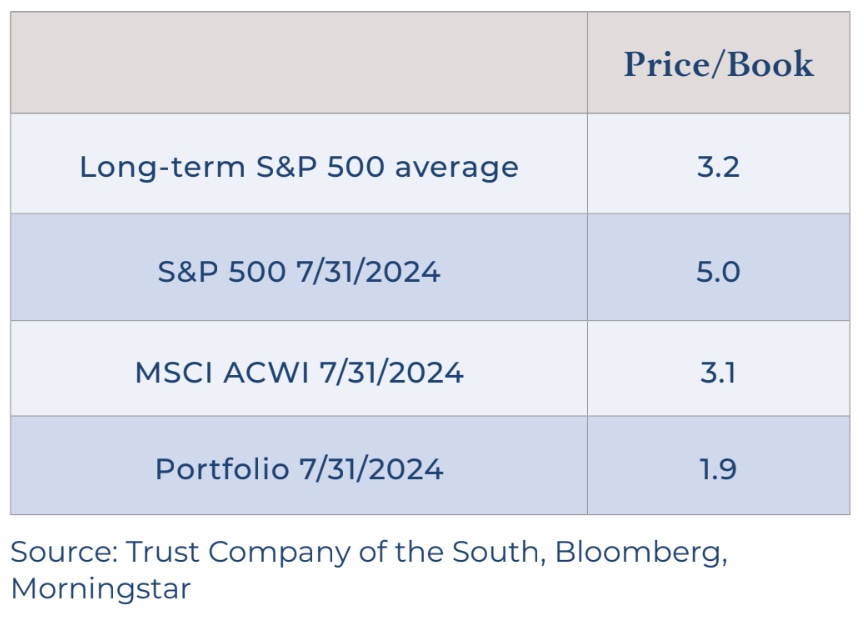

The performance of large caps and mega-cap tech has been remarkable not just because of its scope and durability but also because of the timing. Typically, we see large caps with their strong balance sheets serve as safety trades during difficult markets and a weakening economy. That has not been the case for several years. Normally, small-cap stocks are the primary beneficiary of confident investors. We’ve seen the opposite being played out, and the difference between prices being paid for a handful of large companies and the rest of the market has been extreme.

Perhaps it’s the case that as AI loses a tiny bit of its lustre, investors are noticing that earnings growth beyond tech and mega-cap tech is pretty solid right now, and in fact, is expected to equal or exceed that of the largest companies by the end of this year. This suggests this rotation might be in its early stages.

The “Trump Trade”

Some market observers chalked up the rally in small caps and value stocks to speculation that Donald Trump would again win the presidency. The thinking was that a Trump administration would benefit smaller companies via protective tariffs and other measures intended to spur the U.S. economy, and when he was standing bloodied and defiant on a podium in Butler, PA, having narrowly survived an assassin’s bullet, it seemed his re-election was a certainty. Shockingly, just a few weeks later, he is not only facing a new opponent in Kamala Harris, but is locked in a tight race, and related or not, small caps have given back some of their performance. It’s a classic example of why investors are generally well-served to express their politics at the ballot box and not in their portfolios. As Ferris Bueller said, “Life moves pretty fast.”

No matter who wins the presidency, broadly speaking, small caps and value stocks still look a lot more attractive on a fundamental basis than growth shares. The margin of safety conferred by much more modest valuations is likely to come in handy as the economy cools, even if markets finally get their beloved rate cuts later this year. So, while we would normally expect small-cap stock performance to be challenging amid a softening economic backdrop (and that has been what we have seen so far in August), more modest valuations ought to provide some help.

Think of valuations as a source of protection when things go sideways, like the way Simone Biles’ stature and strength protected her when she made a mistake on her uneven bars routine. During her routine, Biles released her grip on the upper bar too early at one point, causing her to lose momentum as she swung toward and under the lower bar. The only way she was able to avoid hitting the floor was because she was so small (and so strong!), swinging underneath the lower bar and narrowly escaping disaster. Biles thus preserved her chances in the all-around competition. The moral of the story: When you don’t have very far to fall, and you’ve got strong fundamentals, you can avoid a lot of problems.

The economy is definitely cooling a bit. Earnings conference calls this season frequently featured executives citing a slower consumer demand. Our own conversations with executives have been similar. No panic to be sure, but definitely a sense of increasing cautiousness.

As economic clouds gather and investor sentiment seems to be deteriorating, we feel confident about the way our portfolios are positioned.

Click Here to Download the PDF.

For more information, please reach out to:

Burke Koonce III

Investment Strategist

bkoonce@trustcompanyofthesouth.com

Daniel L. Tolomay, CFA

Chief Investment Officer

dtolomay@trustcompanyofthesouth.com

This communication is for informational purposes only and should not be used for any other purpose, as it does not constitute a recommendation or solicitation of the purchase or sale of any security or of any investment services. Some information referenced in this memo is generated by independent, third parties that are believed but not guaranteed to be reliable. Opinions expressed herein are subject to change without notice. These materials are not intended to be tax or legal advice, and readers are encouraged to consult with their own legal, tax, and investment advisors before implementing any financial strategy.