February 1, 2023

Market Dashboard

Will the Groundhog See The Fed’s Shadow?

Groundhog Day. What a curious holiday. Evidently, it is a Pennsylvania Dutch version of the German tradition of consulting a badger whether winter weather would last six more weeks. Of course, we Americans have ditched the pedigreed if a bit disagreeable badger for the plump, lovable, but unquestionably everyman’s groundhog. He’s not particularly good at his job, according to the actual record, but I like the trade personally. Assigning meaning to random events is pretty much what humans, as well as fat, furry rodents, do best.

No doubt, as Punxsutawney Phil passes the time waiting for his big day by watching CNBC and reading Barron’s, he will be reflecting on the news that the Fed would only raise rates by 25 basis points this month, easing off the heavy-handed rate increases that characterized most of 2022 though signaling future rate increases ahead.

Will Phil bolt out this evening for a celebratory cocktail?

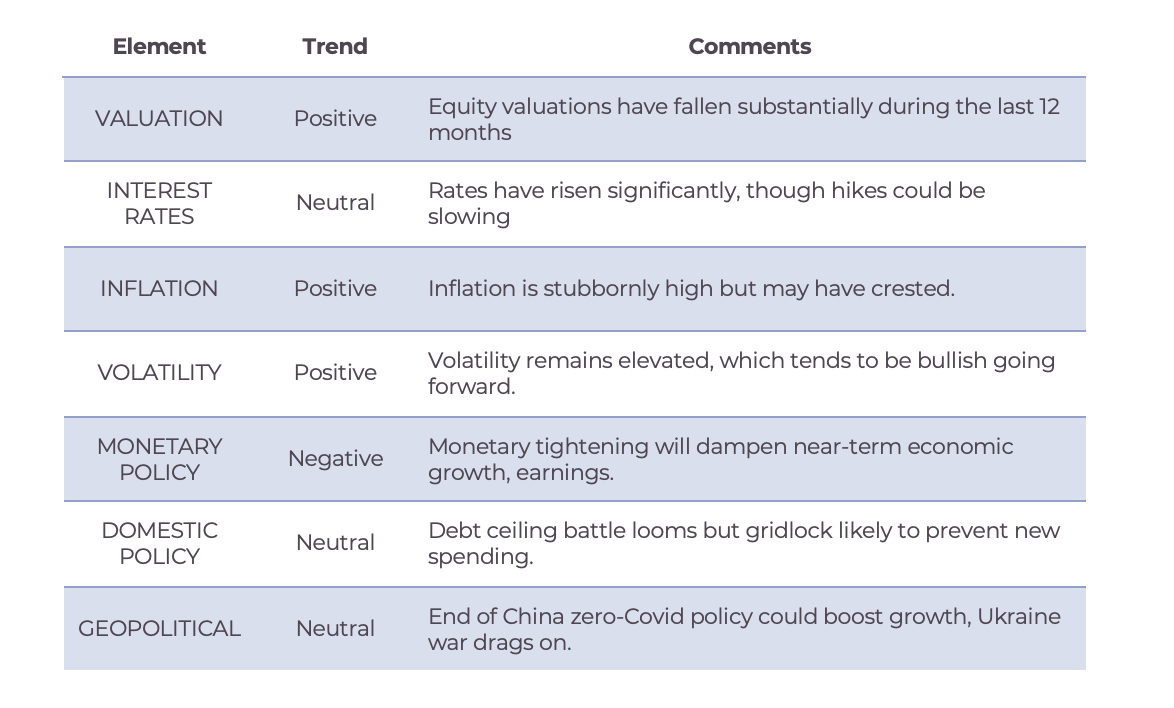

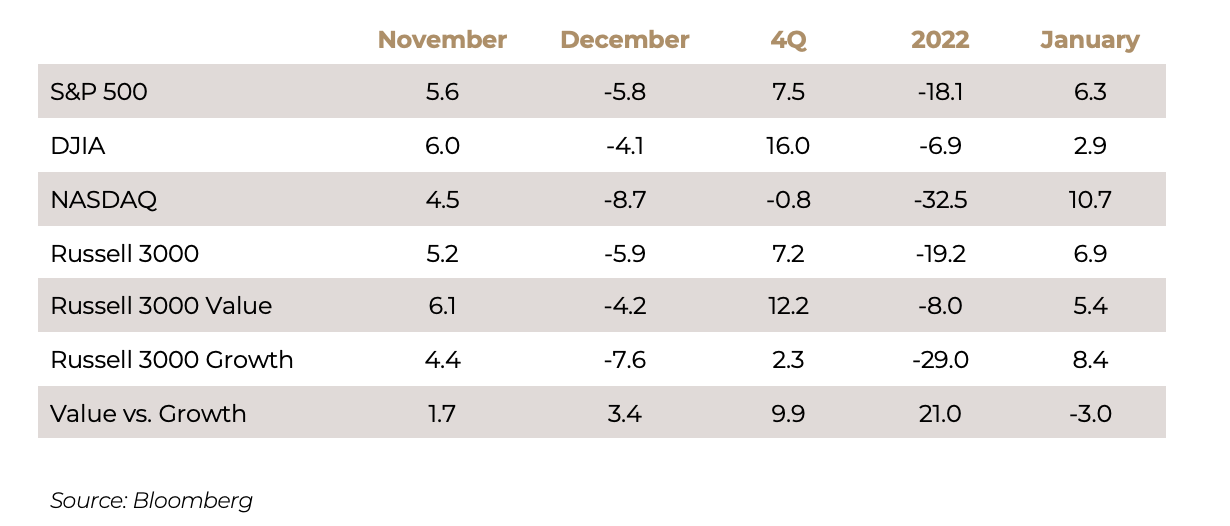

Investors bolted out of their dens in January in anticipation of this relative dovishness, or at least this less hawkish, stance by the Fed (do hawks prey on groundhogs?), driving up markets in expectation that the Fed was much closer to the end of its rate hike campaign than to the beginning. The S&P 500 returned 6.3 percent for the month, while the Dow Jones rose 2.9 percent. The tech-laden NASDAQ was a particularly large beneficiary of the prospect of a steadying Fed, posting an increase of 10.7 percent, its largest advance since January 2001.

Amidst this sudden ebullience, value stocks lagged growth stocks by 3 percent. It was the first month since last July that growth beat value. Not entirely coincidentally, July represented a brief period of interest rate optimism before the Fed raised rates by another 275 basis points for the year (the total for the year was 425 basis points). Certainly, it’s true that growth stocks would seem to have the most to gain from a newly dovish Fed given the rout that growth experienced last year, all else equal.

Of course, all else is never equal, but yes, it’s hard to characterize the Fed’s more nuanced outlook as not being more supportive of economic growth or at least less restrictive. In the Fed’s official statement, the central bank acknowledged that inflation has eased somewhat. Gone were explicit references to supply and demand imbalances related to the pandemic. The 25 basis-point increase was a unanimous decision. The Fed acknowledged the cumulative effects of its actions and the lagged effect those actions could be expected to have as the economy cools.

So now the waiting game begins, not for the weather in Punxsutawney but for more information about how much the Fed’s actions have slowed the economy. And like the good citizens of Punxsutawney and viewers of morning television all across the country, we will be parsing the news for clues. With each new bit of information, we will extrapolate new meanings and conclusions. And we will be tempted to take action, one way or another.

Maybe it would be best to let Phil just do his thing and take it in stride, no matter what he encounters, and not try to overreact to every new bit of news. Maybe that’s the secret, like Bill Murray discovered in the Groundhog Day movie, just trying to get better one day at a time.

We will continue to be vigilant no matter the weather.

For more information, please reach out to:

Burke Koonce III

Investment Strategist

bkoonce@trustcompanyofthesouth.com

Daniel L. Tolomay, CFA

Chief Investment Officer

dtolomay@trustcompanyofthesouth.com

This communication is for informational purposes only and should not be used for any other purpose, as it does not constitute a recommendation or solicitation of the purchase or sale of any security or of any investment services. Some information referenced in this memo is generated by independent, third parties that are believed but not guaranteed to be reliable. Opinions expressed herein are subject to change without notice. These materials are not intended to be tax or legal advice, and readers are encouraged to consult with their own legal, tax, and investment advisors before implementing any financial strategy.