To Infinity and Beyond!

Christmas came early for investors this year, with markets roaring higher during November. Buzz Lightyear himself would be amazed at last month’s investor enthusiasm, which seemed to cement 2023’s name on Santa’s Nice List when, only a few weeks ago, it looked as if much of the market still had work to do to get off the Naughty List. Of course, this robust bullish sentiment was fueled by the near-unanimous bearishness of October. Mr. Market is a manic fellow indeed.

So, what changed? Well, there is a strong argument to be made that Santa Claus might actually be the chairman of the Federal Reserve. Investors may or may not believe in Santa Claus, but suddenly, the market fully believes that Jerome Powell’s Federal Reserve is not just finished raising rates but could be cutting rates when the Easter Bunny shows up in March 2024.

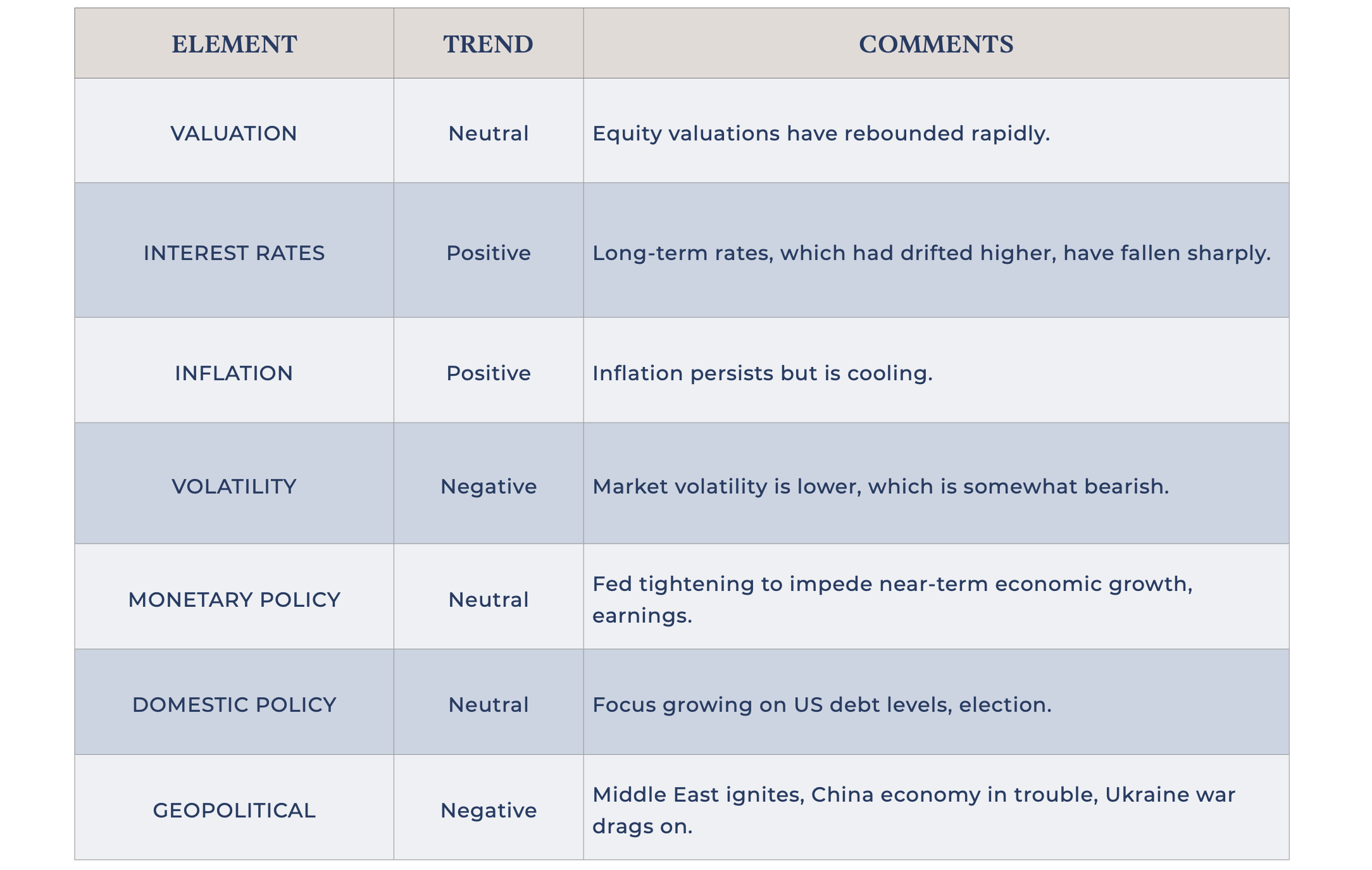

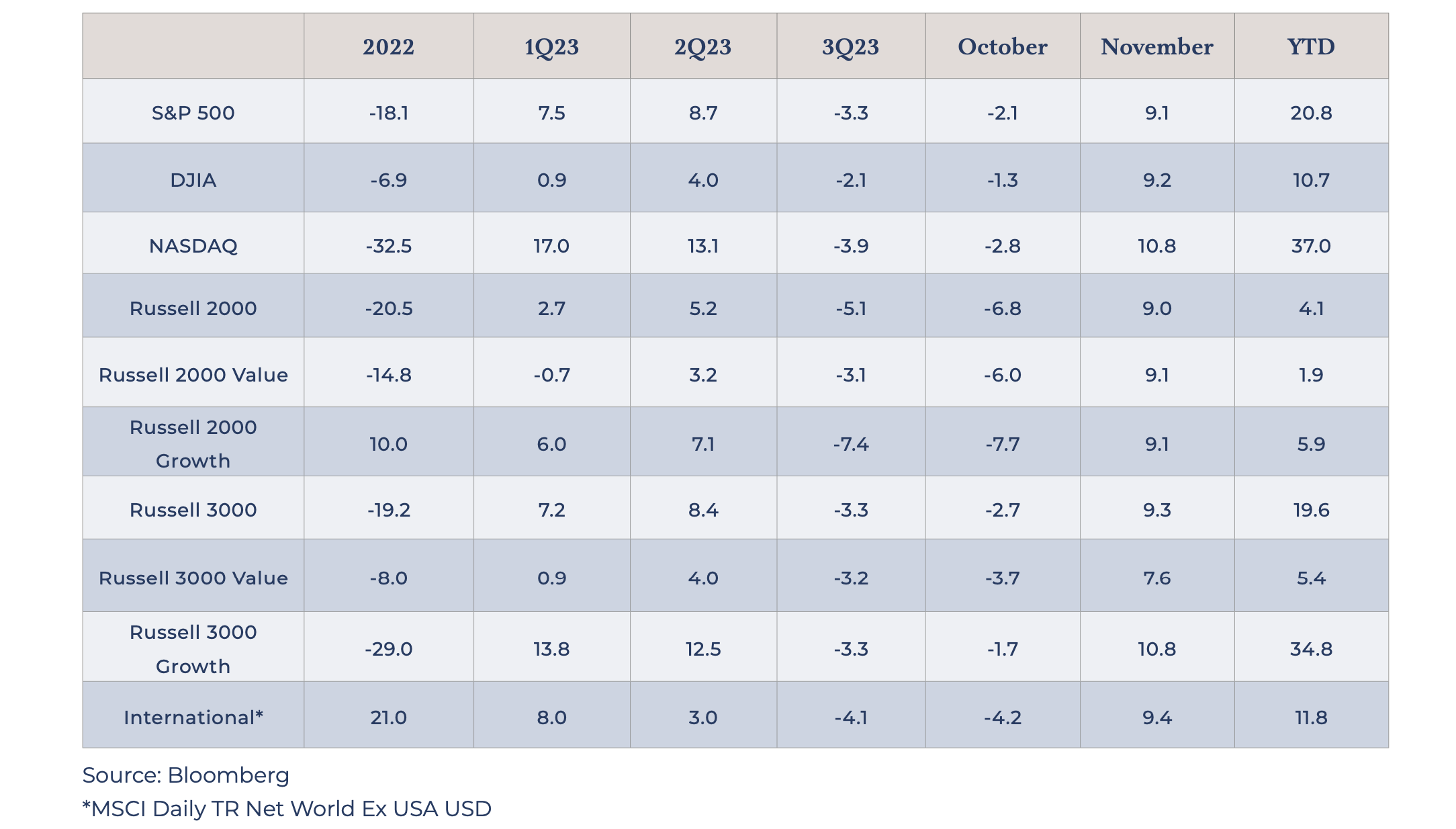

A batch of data indicating that inflation is continuing to weaken and that the economy is slowing but not stalling was all that markets needed to see to immediately start pricing in the elusive soft landing, the Goldilocks scenario of not too hot and not too cold. Whether this actually comes to pass remains to be seen, but that’s what the great discounting machine is currently predicting. Equity markets rocketed higher, with the S&P 500, the Dow Jones Industrial Average and the NASDAQ each up more than 9% for October. Virtually all equity asset classes turned in powerful performances last month: growth stocks, value stocks, large caps and small caps. Continuing this year’s prevailing theme, gains were especially powerful among the largest stocks, with Amazon up 10%, Apple up 11% and Microsoft up 12%. Nvidia rose 15%. Tesla soared 20%. These megacap names, which have led the markets higher this year, continued their meteoric rise. The top ten names in the S&P 500 now constitute 33% of the total market capitalization of the index, a multi-decade high. This is a bull market—an extremely top-heavy one, but a bull market, nonetheless.

While the gains in the equity markets were more or less a continuation of the prevailing themes that have dominated market action all year, the gains in the fixed-income market signified a massive change of outlook. With November’s additional signs of a slowdown in inflation and economic activity, long-term interest rates did an about-face. Just weeks ago, long-term interest rates were moving meaningfully higher as the “higher for longer” narrative had begun to take hold. Then, in the twinkle of a jolly elf’s eye, 10-year Treasury yields, which had risen to almost 5%, collapsed and are now back below 4.2%. That’s a huge change in the bond world with real economic implications, making it much easier for borrowers to access capital and supporting higher asset prices across the board.

So, where does this leave us? While it is difficult not to feel better about portfolios after such a strong month, the real message has to be how fickle the market can be over the short term and how destructive it can be to be overly influenced by short-term events or results. Also, it is difficult not to observe that expectations regarding the actions of the Federal Reserve are still such a massive driver of near-term performance. This doesn’t necessarily seem super healthy, but the market clearly responds to candy canes from the Fed. For now, we’re just grateful 2023 is on the Nice List.

Click here to download the PDF.

For more information, please reach out to:

Burke Koonce III

Investment Strategist

bkoonce@trustcompanyofthesouth.com

Daniel L. Tolomay, CFA

Chief Investment Officer

dtolomay@trustcompanyofthesouth.com

This communication is for informational purposes only and should not be used for any other purpose, as it does not constitute a recommendation or solicitation of the purchase or sale of any security or of any investment services. Some information referenced in this memo is generated by independent, third parties that are believed but not guaranteed to be reliable. Opinions expressed herein are subject to change without notice. These materials are not intended to be tax or legal advice, and readers are encouraged to consult with their own legal, tax, and investment advisors before implementing any financial strategy.