“Ride The Cyclone!”

Some readers of a certain age from these parts will remember that back in the late 1980s and early 1990s, there was an arcade—an actual arcade—on East Franklin Street in Chapel Hill, NC, where students and other wastrels in their salad years would go play games. There were video games there, of course, even back in the comparative Stone Age, but the main attraction was an amusement park-themed pinball machine called Cyclone, located prominently in the front. Passersby on Franklin St. could hear Cyclone’s recorded carnival barker calling to them, exhorting them to come drop a couple of quarters and “Ride the Ferris Wheel!” or “Ride the Cyclone!” Everyone’s favorite callout was when the game was over, and the ghostly barker would wryly proclaim, “You pay your money, you take your chances.”

Readers don’t even have to be of a certain age to appreciate how the last several years in the financial markets have been quite a lot like riding the proverbial Cyclone. Last year certainly fit the bill.

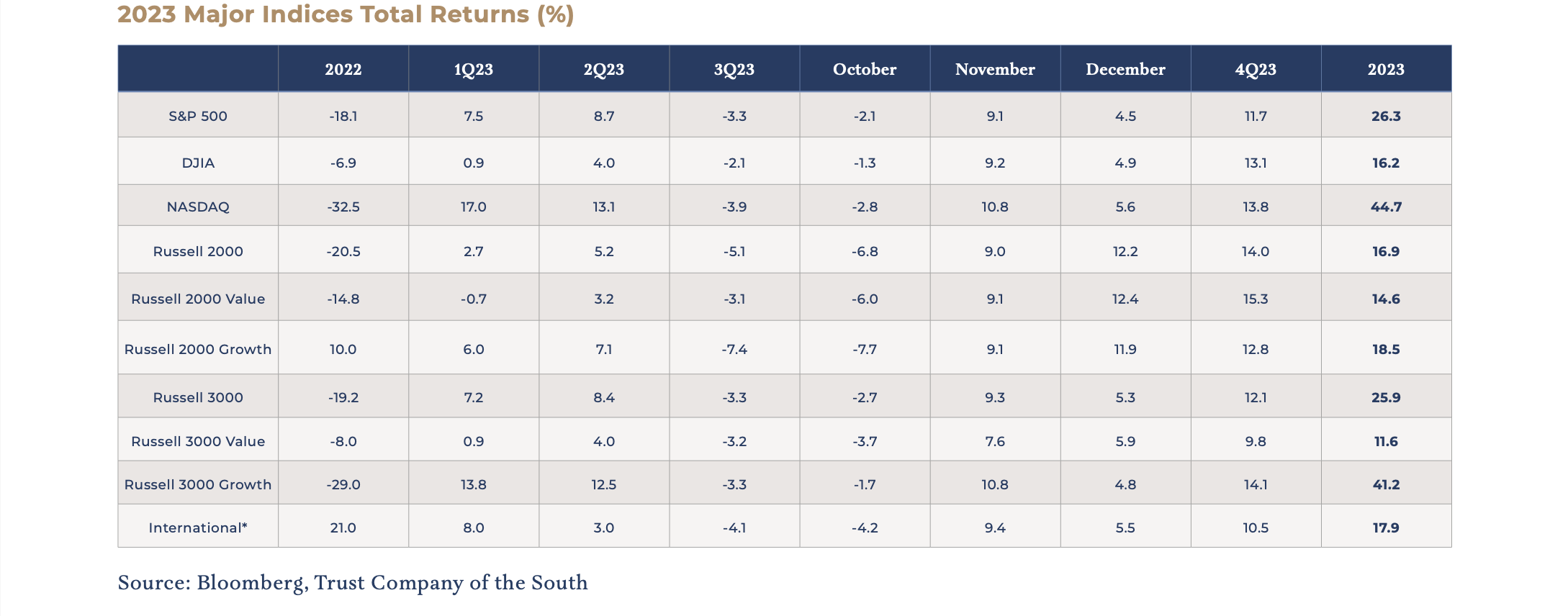

Despite being down double digits at one point, the S&P 500 finished 2023 up more than 26%, roaring into the New Year with a fourth-quarter return of almost 12%. The Dow Jones Industrial Average returned more than 16% for the year, with most of its gains in the fourth quarter. The tech-heavy NASDAQ soared almost 45% for the year and boasted an almost 14% Q4 gain.

The year 2023 will be remembered for featuring one of the narrowest equity market rallies in history, with the overwhelming share of returns coming from price appreciation in just ten stocks. The top ten stocks in the S&P 500 contributed 86% of the index’s price return last year, according to J.P. Morgan. That’s because the top ten stocks returned 62%, while the rest of the index returned just 8%. Accordingly, by far, the largest determinant in performance for the year was the extent to which portfolios had exposure to this enormous rally among the absolute largest names. More than 70% of stocks in the S&P 500 underperformed the index! Growth strategies outperformed value strategies, and large-cap strategies tended to outperform small-cap strategies for the year, although small-caps and value both finished the year outperforming in the fourth quarter as the market further contemplated the apparent end of rising interest rates. As of year-end, the NASDAQ, the most tech-sensitive major index, had recovered almost all of its 2022 losses.

“We Have A Winner!”

The big story of 2023 equity returns was excitement regarding the economic implications of artificial intelligence. The advent of AI created a firestorm of interest in companies that are seen to potentially benefit from directly incorporating AI into their business models, most specifically Amazon, Apple, Google, Meta, Microsoft and NVIDIA. There is no doubt that artificial intelligence represents an extraordinary opportunity for—and quite possibly a major threat to—humanity. There is an arms race taking place among each of these giant firms and others for dominance as AI eventually materializes into a commercial force. The challenge that investors face is accessing actual earnings generated by AI tools. While the valuations of these companies have risen by hundreds of billions of dollars in anticipation of the long-term benefits of AI to the bottom line, current revenue actually attributable to generative AI is, according to some estimates, not quite $20 billion globally. That’s really just not that big. Of course, the whole point is that the market will grow, perhaps by 500x, but given that assumption, is it not likely a fair bet that other companies, companies which will become incrementally more productive and more profitable via using AI but which trade at normal or even below-normal prices, will put AI dollars back in investors’ pockets sooner? That’s the difference between “voting” for AI and “weighing” AI as an investment. Right now, if an investor owns an S&P 500 index fund, he is immediately overweight AI because of the run-up in a handful of mega-cap stocks.

“Ride the Ferris Wheel!”

Having completed one more rotation around the sun, it’s time to look back at our expectations for last year and examine how they fared, giving ourselves kudos for what we expected that actually happened and marveling at our myopia over what we did not anticipate. Last year at this time, investors of all stripes were licking their wounds. There had been carnage in both the equity and fixed income markets (the venerated 60/40 model was down 16% on the year, the worst performance since 2008).

There had been a smattering of news reports regarding AI as 2022 was coming to a close, but nothing that would have suggested that a massive rally that would gain momentum throughout the year was about to take place. Our expectation was that higher interest rates would suppress valuations, particularly among the priciest valuations. Wrong!

Here’s what we wrote in January 2023:

The Fed-engineered inverted yield curve does not guarantee we will have a recession in 2023, but it certainly suggests deceleration. In such an environment, we believe investor sentiment could deteriorate, dampening valuations, and sentiment might be expected to deteriorate the most in areas in which valuations are particularly high.

However, we did have confidence that that market could move higher. Why? Because of our conviction that valuations matter, and valuations had become far more attractive. In the same letter, we wrote:

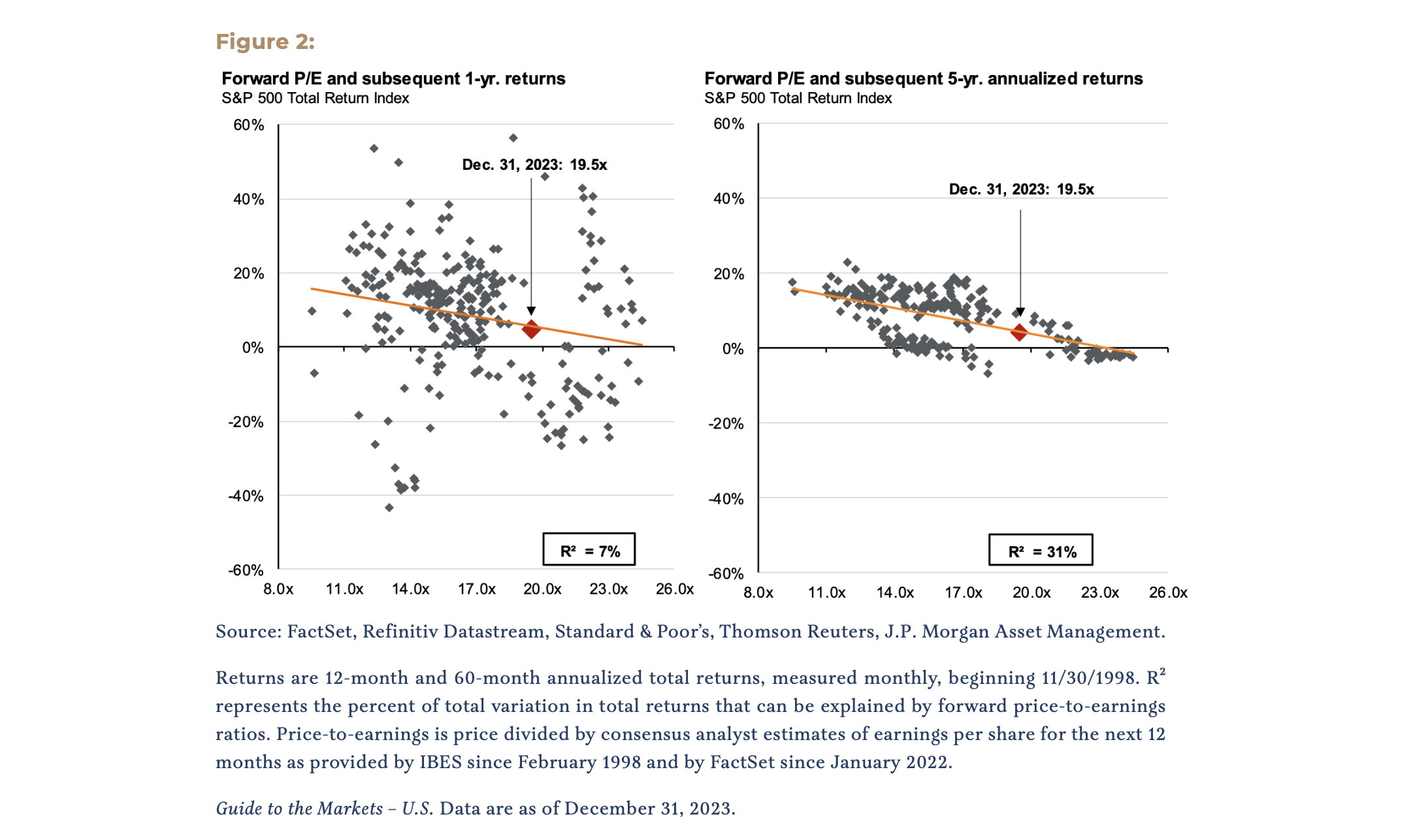

Based on history, not to mention logic, investors experience better future returns over the long term when entry valuations are lower vs. higher. Said another way, it’s better to pay less than more. Just over a year ago, the price/earnings ratio on the S&P 500 was above 22x, more than 30% above the index’s 25-year average of 16.8x. Fast forward to year-end, and the index was trading at 16.7x. It doesn’t take a math major to understand that one’s odds of future success have likely improved.

So, while we did not advocate for piling every dollar into NVIDIA, neither did we waver in our belief that valuations drive performance in the long term.

We also noted how rare such large market declines as last year were and how extraordinarily rare a decline would be after such a large drop:

Still, let’s contemplate the scenario in which the worst is behind us. There are valid reasons to believe this is the case. Two down years in a row are rare; since 1926, the S&P 500 has experienced back-to-back declines only eight times. Rarer still are annual market declines of 18% or more— that’s only happened seven times since 1926. Even rarer is an annual decline of more than 18%, followed by another down year. The last time that happened was 1931—Herbert Hoover was president, Prohibition was ongoing and Dean Smith had just been born.

“Hurry, Hurry, Step Right Up!”

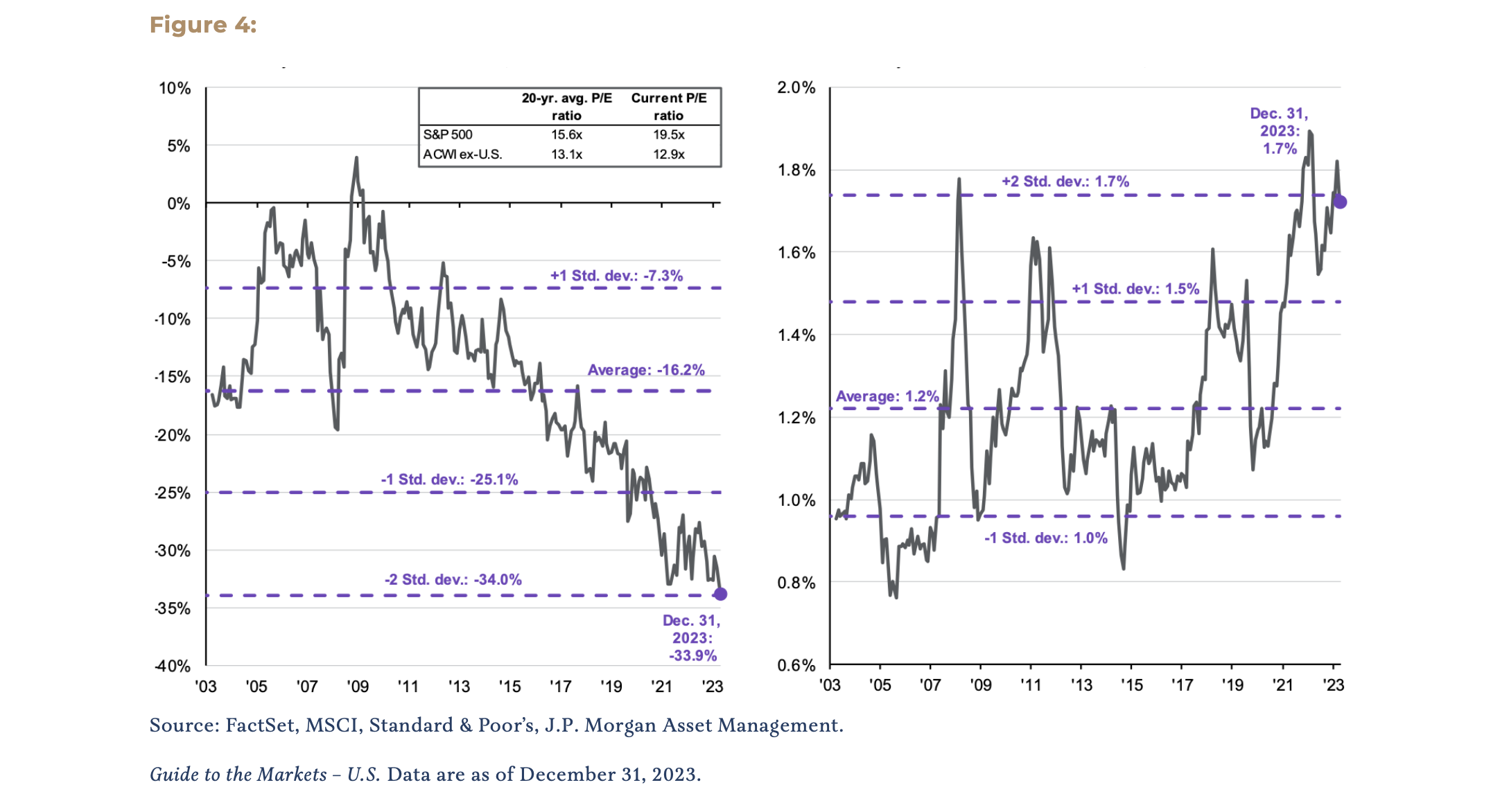

So what does the future hold? Well, as excited as a 26% return on the S&P 500 and a 45% return on the NASDAQ can make investors, our observation is that higher current valuations tend to suppress future returns. All else equal, we’d rather pay less than more for a given stock. That means, all else equal that we would be slightly less enthusiastic about what markets might return in the near term. However, all else is not equal. We actually feel pretty good about stocks in general, given the historic concentration of last year’s advance. It’s just the tip top of the market we worry about—the trouble is, the tip top (the top ten stocks) grew to represent about a third of the value of the S&P 500. That’s a lot. But while the top ten stocks were trading for 26.9x forward earnings as of the end of 2023, the rest of the index was only priced at 17.1x, a discount to its historical average.

We are decidedly more confident in the returns that the rest of the market, particularly smaller issues and international stocks, can generate in the near term.

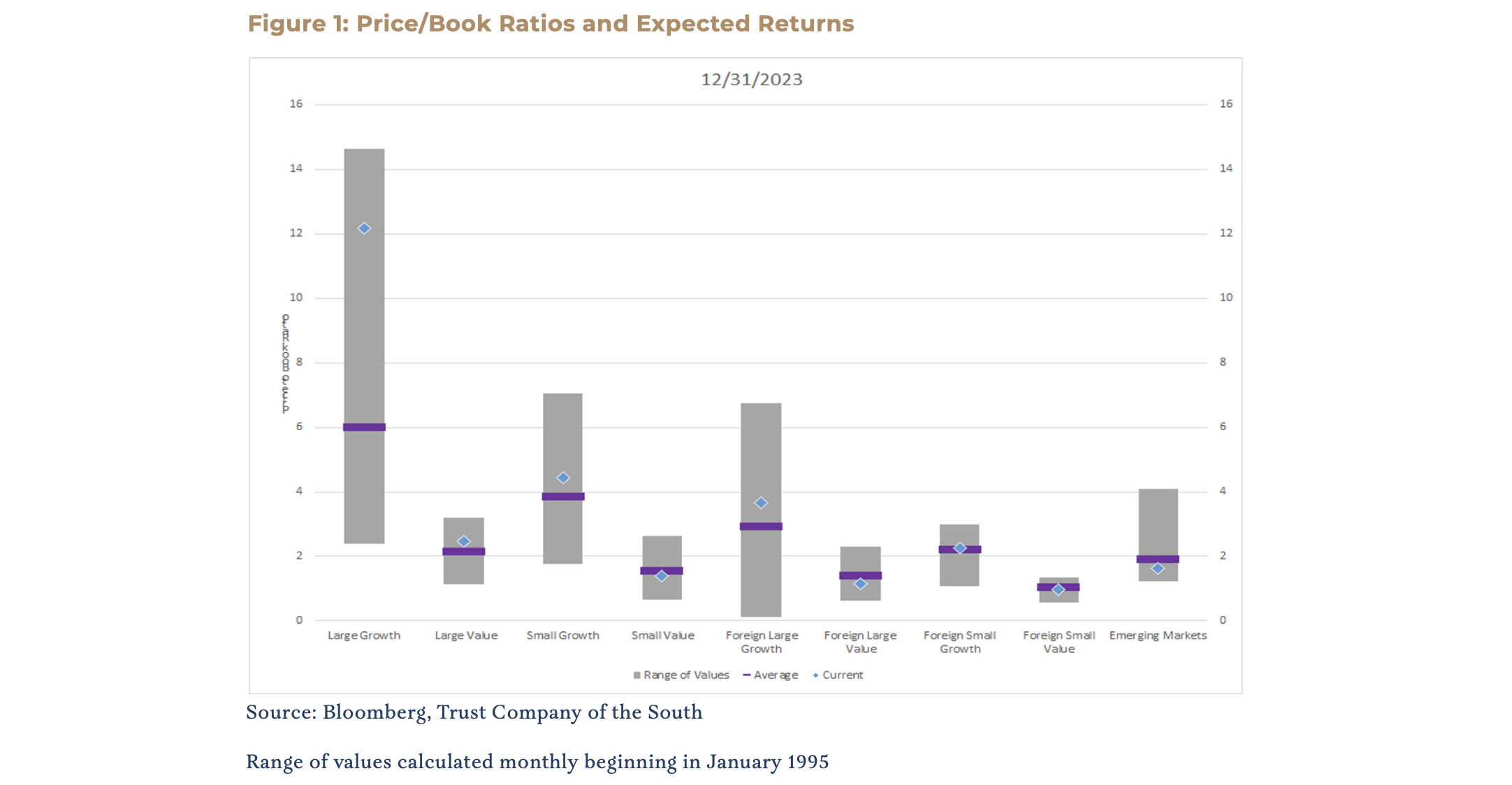

This is because, as the above chart shows, most equity asset classes are trading quite close to their historical averages. Examining price-to-book ratios going back to the mid-1990s, only one asset class seems out of whack—large-cap growth, which can now be yours for the low, low price of 12x book value. Of course, we observed last year that large-cap growth was already by far the most expensive sector vs. the other asset classes and its own history—when the category was trading at roughly 9x book value.

Valuation is not a particularly strong determinant of future investment returns in the short term, but it grows more powerful over time. Many factors can affect near-term performance: momentum, index inclusion or exclusion, or macro events, but over time, earnings have to materialize.

“You, Sir and You Madam!”

We all felt the impact of rising inflation, but the worst of it is clearly behind us. Recent CPI reports are far closer to the Fed’s 2% target than a year ago. The falling rate of inflation helped generate optimism in the markets during the fourth quarter that the Fed’s campaign of interest rate hikes is quite near, if not at, its end. Within equity markets, we observe that stocks of companies that had been sizable users of debt would be the biggest beneficiaries of stabilizing and lower interest rates. Not surprisingly, many of these companies are smaller firms, outside the S&P 500. For this reason, we observe that our “tilt” toward small-cap stocks likely benefit in the near term.

This is going to get very wonky very fast, but it’s also worth noting that despite interest rates climbing to 22-year highs, major stock indices were not negatively impacted last year. One could argue that this was because the pain was already experienced in 2022, but the problem with that is that longer-term rates, which theoretically affect stock prices, did not move meaningfully higher until well into this past year. Ten-year Treasury yields move in the opposite direction of Treasury prices and also normally in the opposite direction of prices of just about everything, including stocks. Ten-year Treasury yields were about 2.5x as high at the end of 2023 as they finished in 2022, but stock indices are still quite richly priced. Does this further suggest that stocks are expensively priced—at least vs. bonds—or is this because index prices are so distorted by the crazy prices of the largest companies? With bond yields where they are, don’t bonds look somewhat attractive by comparison?

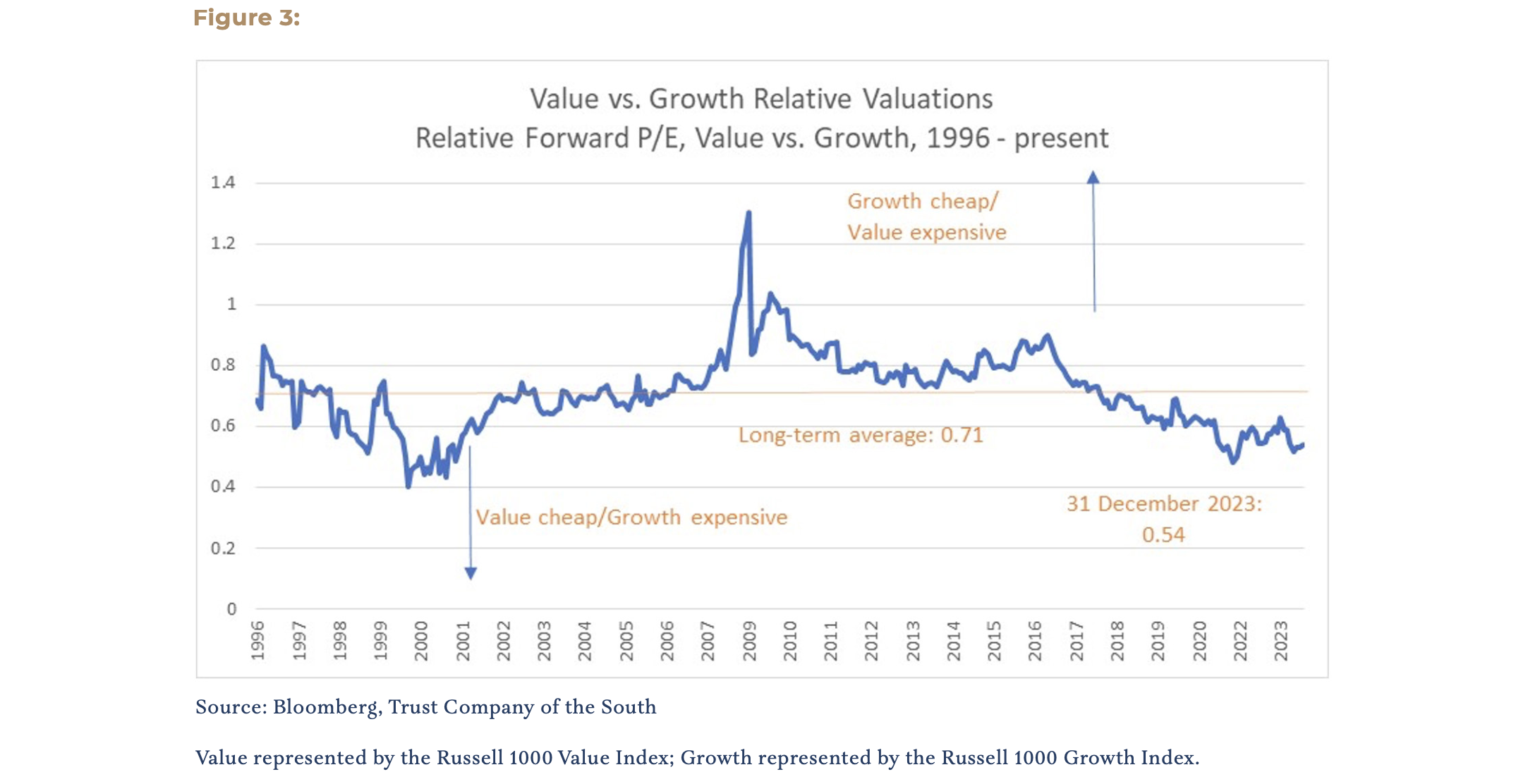

All the more reason to suspect that the tilt we discuss the most—value—seems poised to perform.

Broadly speaking, value stocks have not been this inexpensive vs. growth stocks since the tech bubble of the late 1990s. Meaningful outperformance from value would not require a return to the washout of the Great Financial Crisis; just a natural course toward the long-term average price relationship would suffice.

The same massive price differential drives our view on international stocks, which are also trading at historically attractive levels. There is a case to be made that the performance dispersion between growth and value is created by the same force that creates the performance gap between domestic and international, namely big tech. There are just not as many wildly valued companies overseas as in the U.S. So, whenever the bloom comes off the rose in mega-cap tech, international markets will likely provide valuable relative performance.

“Hey, You With The Face!”

The Franklin St. arcade (it was called Barrel of Fun, by the way) is long gone, as, of course, is Cyclone. Cyclone’s brand, Williams, was shuttered in 1999 by WMS Industries, which was eventually merged with another firm. I mean, let’s face it, part of Cyclone’s charm was that it was already a bit of a relic, even before the likes of Lara Croft and Zelda finished it off. That’s the nature of technology and the nature of creative destruction. Today’s hot technology has a way of becoming tomorrow’s pinball machine. Today’s most valuable firms are not always but usually tomorrow’s Lucents, AOL Time Warners, and Ciscos.

We are extremely enthusiastic about how portfolios are positioned in this environment, and we look forward to another great year. As always, we thank you for the confidence you have placed in our team.

Click here to download the PDF.

For more information, please reach out to:

Burke Koonce III

Investment Strategist

bkoonce@trustcompanyofthesouth.com

Daniel L. Tolomay, CFA

Chief Investment Officer

dtolomay@trustcompanyofthesouth.com

This communication is for informational purposes only and should not be used for any other purpose, as it does not constitute a recommendation or solicitation of the purchase or sale of any security or of any investment services. Some information referenced in this memo is generated by independent, third parties that are believed but not guaranteed to be reliable. Opinions expressed herein are subject to change without notice. These materials are not intended to be tax or legal advice, and readers are encouraged to consult with their own legal, tax, and investment advisors before implementing any financial strategy.