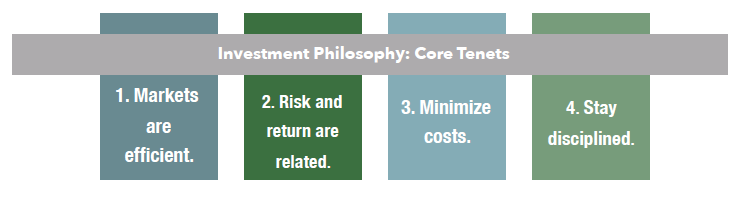

A philosophy can be defined as “an attitude held by an individual or organization that defines its behavior.” This, in essence, is how we view our investment philosophy at Trust Company of the South. It is not a theoretical concept. Rather, it is a concrete belief that drives our daily behavior as advisors. Consistency of investor behavior ultimately determines one’s investment success. Our philosophy has four core tenets. These foundational statements underpin our response to the current crisis:

Current Events

The most commonly used word we are hearing these days is “unprecedented”. Certainly what is happening today is unprecedented. There is no doubt. Without minimizing that fact, most crises are unprecedented.

September 11th is a relevant example. We had never had an attack on US soil (Hawaii was a territory during the attack on Pearl Harbor). We did not know what normal life would look like or how we would ever get back to it. The 2008-2009 Global Financial Crisis offers another comparison. For the first time ever, the “safest” asset on any household’s balance sheet, their home, began losing value. People were underwater in a matter of weeks as the number of foreclosures grew exponentially. The economic toll weighed on the economy for years.

Every crisis has a unique story, and each story in most people’s eyes is unprecedented. But if you listen closely, each story rhymes. First, an unprecedented event occurs, then markets enter a free fall. When the last drops of hope are gone, markets begin rising, and disciplined investors reap the reward.

Markets are efficient.

Beyond the research and data that support this statement, consider the conundrum of believing that markets are inefficient. The problem with this view is that you must now guess what the market has and has not priced in yet. How much worse will things become? What will be the ultimate economic cost? When will stocks fully recover? What will perform best going forward? These are questions no one can answer.

In our view, markets are extremely efficient. The recent volatility in prices proves this point. Early in this crisis, the market traded wildly up or down each day. The financial media likes to add a narrative to each trading day, but ultimately, each day prices are being moved to fair value based on any new information. We are receiving a lot of new information every day – every hour in fact. The market is excellent at processing new information. It leaves no opportunity to benefit from new information.

So why are prices falling so much and so quickly? Investors are recognizing that uncertainty (i.e. risk) has increased, and they are rightly demanding higher returns in the future in order to buy stocks today. It really is that simple.

What are we doing?

At this point, you may be wondering if our sage advice, honed over almost three decades, is to do nothing. Absolutely not!

Market downturns, painful as they may be, present a plethora of prudent planning opportunities. Every day our team is actively engaging with clients to improve their financial lives and advance the financial well-being of their children and future generations. Some of these opportunities include:

Investment Opportunities:

- Harvest tax losses to offset future gains

- Rebalance stock to bond allocations

- Sell risky concentrated stock positions with lower tax burdens

- Put excess cash to work in the market at lower prices

Financial Planning Strategy

- Refinance home mortgage to take advantage of low rates

- Convert a traditional IRA to a Roth IRA while account values are down and in light of SECURE Act changes

Estate Planning Suggestions

- Low AFR rates present planning opportunities

- Enter into or refinance an intra-family loan

- Enter into a sale of assets at depressed values with intentionally defective grantor trust for a note with a low interest rate

- Charitable lead trusts and GRATs work best in a low interest rate environment

- Front load up to five years of annual exclusion gifts into a 529 plan to potentially capitalize on a market rebound

- For taxable estates, use historically high exemptions before they are taken away (by sunset or a new administration) to make gifts at depressed values

- Gift to a spousal lifetime access trust (“SLAT”) preserves access to the gifted assets via the spouse

History is on our side.

Trust Company is no stranger to market downturns. We have walked alongside our clients through the savings and loan crisis of the early 1990s, the 1997 Asian financial crisis, the Tech Wreck of the early 2000s, September 11th, the Great Financial Crisis of 2008-2009, the 2011 European debt crisis, and countless other impactful events. Every market downturn is unique or unprecedented in cause yet similar in resolution. Stocks rise again. The economy resumes. Disciplined investors are made whole and continue growing their wealth. In fact, those who stick to plan and remain steadfast do not just endure – they stand to benefit.

All this to say: our seasoned team stands ready to serve you in good times and bad.