Wealth Planning

Take the Worry Out of Wealth

From our decades of working with wealthy families we have found that coordinated planning can make all the difference in a family’s ability to preserve and transfer wealth successfully.

Most clients come to us initially for investment advice, but we’ve found what they need and what they want is complete wealth planning that coordinates all the aspects of their financial lives. The planning we provide is based on your goals, circumstances, and unique needs and includes everything from estate planning to retirement planning, to real estate to legacy planning.

Make Sure Your Intentions Become Your Reality

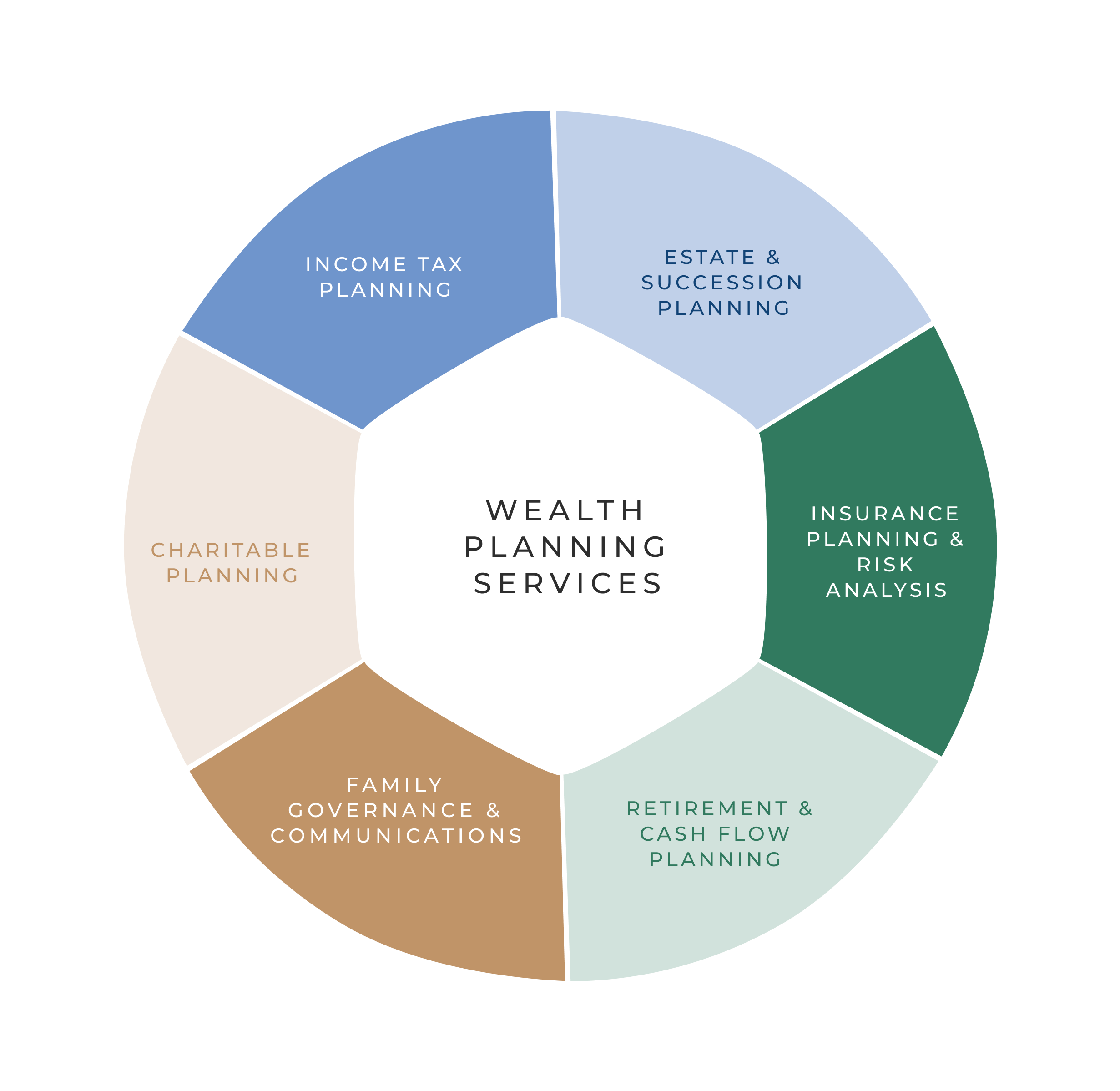

Estate & Succession Planning

Analyze and monitor your estate plan, provide updates and strategies for you to consider and work with your attorney to implement improvements to your plan.

Charitable Planning

Ascertain your charitable objectives, develop strategies to meet those objectives, and provide investment advice and administrative support for any charitable vehicles implemented.

Family Governance & Communications

Enhance family communications and serve as a resource for information, advice and education for family members.

Retirement & Cash Flow Planning

Determine cash flow goals (income, expenses, gifting, etc.) and what is needed to achieve those goals, prioritize current and future needs while identifying and managing risks that may delay or prevent a successful outcome.

Insurance Planning & Risk Analysis

Review and assess current insurance needs (life, P&C, long term care, health), make recommendations for changes in types or amounts of coverage, and work with outside insurance advisors to implement changes and monitor/update your insurance plan.

Income Tax Planning

Consider strategies to reduce federal and state income taxes for you and your related entities and coordinate implementation of recommended strategies with your tax advisor team.

Navigating Life Events